Butterfly / Condor

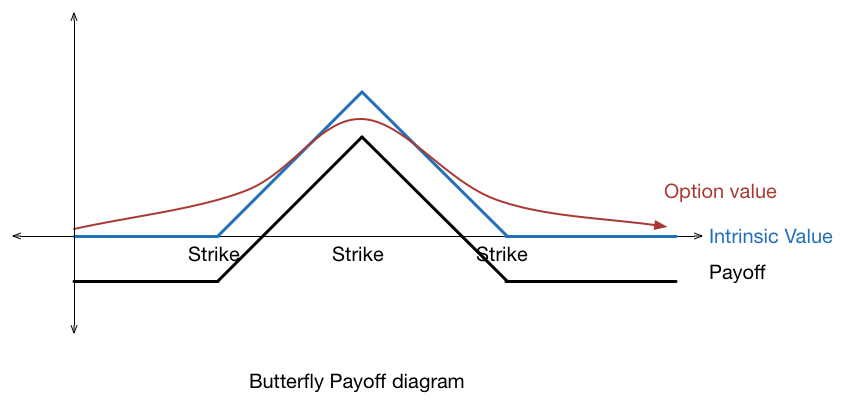

The butterfly consists of being long 1, short 2, long 1 options across different strikes.

The long butterfly can be constructed using either just calls, just puts, or a combination of both. It can also be thought of as being short a call spread and short a put spread.

The butterfly often has equidistant strikes. The call butterfly (and put butterfly) with equidistant strikes will never have a negative payoff, hence this offers a arbitrage opportunity if the price of the butterfly was negative.

The butterfly is often described simply by the strikes. For example, if you are long a 10-20-30 butterfly, you are long 1 option on the 10 strike, short 2 options on the 20 strike, and long 1 option on the 30 strike. The 10-20-30 call fly would thus be long the call option on the 10 strike, short 2 call options on the 20 strike and long 1 call option on the 30 strike.

The strike in the center is known as the "meat", while the strike at the ends is known as the "wings".

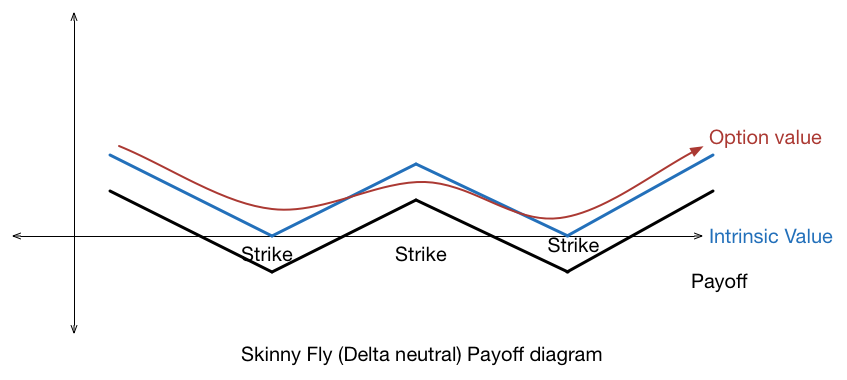

A skinny fly consists of being long 1, short 1, long 1 option across different strikes.

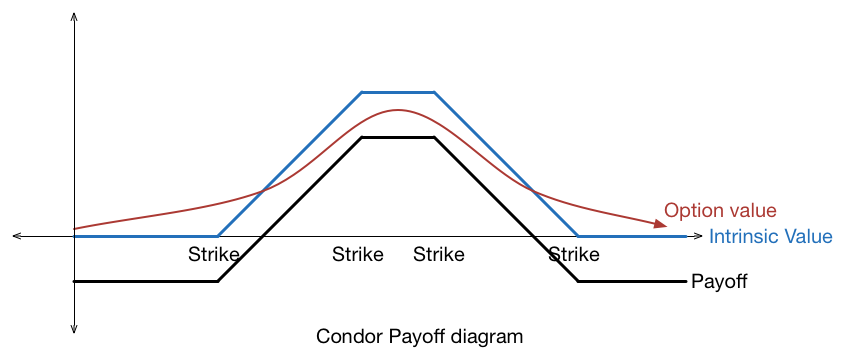

The condor consists of being long 1, short 1, short 1, long 1 option across 4 different strikes. As before, it is often described simply by the strikes of the option contracts.

Payoff diagrams

The skinny fly is best understood from a delta-neutral perspective, to understand the effects of the position. As such, the payoff diagram will include some stock trade.

Greeks of position

When the underlying is near to the middle strikes (meat), the long butterfly and condor positions are:

1. Delta neutral (or close to)

2. Short Gamma

3. Collecting Theta

4. Short Vega

Note: The butterfly is unique because it is the (one of the few) option strategies where you are long it, while collecting theta.

Favorable conditions for trade

Consider buying butterflies and condors when

1. You believe that the underlying will trade in a tight range

2. You believe that the underlying will trade in a tight range, or move significantly. In this case, the long wings offer you protection against the move.

Situation 2 could occur when there is no strong reason for a move, but there is a strong reason for a directional move if the underlying starts to move. Examples include an increase in margin requirement which could cause forced liquidation, and overbought / oversold situations. In this case, a skinny fly might work better. Though it is more costly without movement, it pays off handsomely when the move is sudden.