Straddle / Strangle

This is an advanced topic in Option Theory. Please refer to this Options Glossary if you do not understand any of the terms.

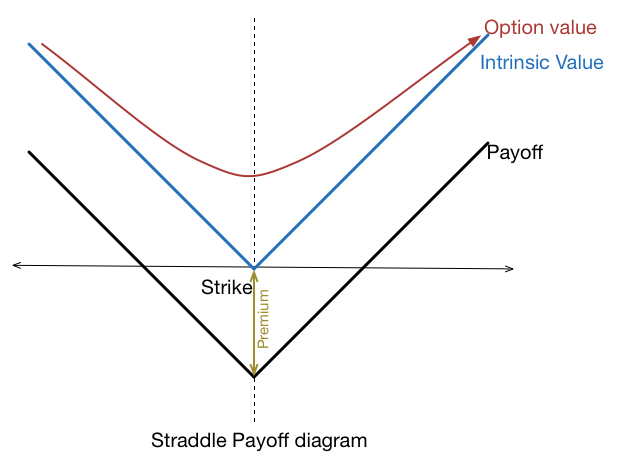

A straddle is an option strategy in which a call and put with the same strike price and expiration date is bought. A strangle is an option strategy in which a call and put with the same expiration date but different strikes is bought.

These strategies are useful to pursue if you believe that the underlying price would move significantly, but you are uncertain of the direction of the movement. However, if the direction of the movement is not significant enough, then a loss will still be incurred. Hence, these are extremely risky strategies if the realized volatility isn't higher than the implied volatility of the options.

Straddle and Strangle

A straddle refers to both a call and a put option on the same strike, with the same expiration. Usually these options are near ATM.

The straddle at strike \(X\) is often denoted as \( Y _ X \).

An investor bought the straddle on the $50 strike for $6. What price must the stock expire at in order for the investor to make money?

In order to make money, the value of the options must be more than $6. On expiation, the put and call options cannot be both in the money.

If the call was worth $6 or more, that means that it has an intrinsic value of $6 or more, or that the stock price was at least \( $50 + $6 = $56 \).

If the put was worth $6 or more, that means that it has an intrinsic value of $6 or more, or that the stock price was at most \( $50 - $6 = $44 \).Hence, in order for the investor to make money, the stock must be either above $56, or under $44.

A strangle refers to a call and a put option on distinct strikes, with the same expiration. Usually these options are OTM. If both of these options are ITM, then it is known as a gut strangle.

Let Y be the strangle that consists of the $45 put and the $55 call. An investor sold the strangle for $5. What is the range of values of the stock on expiration, such that the investor would have made money?

Payoff Diagrams

Greeks of position

When the underlying price is close to the strikes, long straddles and strangles are

1. Option value is mostly extrinsic

2. High Gamma

3. High Vega

4. Paying a lot of theta

When the underlying price has moved through the strike, long straddles and strangles are

1. Option value is mostly intrinsic

2. Lower Gamma

3. Lower Vega

4. Paying less theta

5. High skew risk

The stock is currently trading at 30. Which option strategy has the most (positive) vega?

The options all have the same expiry date.

Favorable conditions for trade

Consider buying straddles and strangles in the following situations:

1. You believe that the underlying will move more than the implied volatility

2. You believe that the volatility will increase soon

3. You believe that the underlying will move significantly in one direction, and do not know which direction or for how far.

Note: Despite having high Gamma, owing straddles/strangles are useless if the underlying is highly volatile within a tight range, that does not allow you to do any delta hedging. In particular, if you own the 95-105 strangle, and the underlying trades back and forth between 99-101 a lot, it will be very hard to make money. In such a situation, it is better to be short the strangle / straddle and not hedge too aggressively.