Forward contract

This is an introductory page in Options. If you are unfamiliar with any of the terms, you can refer to the Options Glossary.

A forward contract (forward) is a non-standardized contract between two parties, to trade an asset at a specified price, and at a specified future date. The seller will deliver the underlying and the buyer will take delivery of the underlying. The price that is agreed on, is known as the forward price or the delivery price, and is determined when the contract is entered into. Since the price of the forward is dependent on the price of the asset, this is a derivative instrument.

A forward contract is very similar to a Futures contract. A forward does not trade on a centralized exchange, hence is regarded as an over-the-counter (OTC) instrument. While this allows the contract to be customized, it also results in a higher degree of default risk. Hence, forward contracts are not usually available to retail investors.

True or False?

A forward contract is easily traded.

Features of a Forward

Each contract can be set up with it's own terms, and thus may be tailored to the individual.

A forward contract should state:

The underlying asset

The amount and quality of the underlying asset. For example, 1000 bushels of Grade 4 corn.The time of maturity \( T \)

The date at which the underlying is to be delivered. This could be a specific date, or a time range.The place of delivery for physical underlying The place(s) at which the underlying is to be delivered. As the contract is customizable, this is often determined by the buyer.

Mark-to-market or daily margin calls

This helps to reduce the risk that either party might default on the trade, as collateral (cash, the underlying, securities, etc) is provided as insurance. The margin calls can also be based upon trigger events, like credit worthiness or stock price.The delivery price \( K \)

The price that is to be paid. This could be quoted as a per unit amount ($3.00 per bushel) or a total amount ($3000).

A forward contract is similar to a Futures contract, in that they agree to trade an underlying at a specified future date. However, forward contracts are

1. not cleared through an exchange,

2. not standardized,

3. might not require posting a margin,

4. have significant counter-party risk.

You buy a May Gold Forward contract from a Lehman Brothers trader. What happens when Lehman collapsed?

You buy a May Gold Forward contract from a Lehman Brothers trader. What happens when Lehman collapsed?

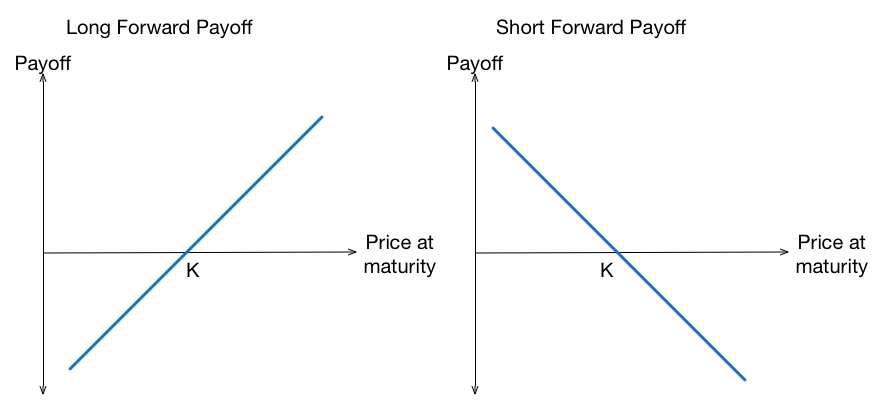

Payoff Diagrams

The value of a forward position at maturity is the difference between the delivery price \( K \) and the underlying price \( S_T \) at the time of maturity.

For a long position, the payoff is \( S_T - K \), and it will benefit from a higher underlying price.

For a short position, the payoff is \( K - S_T \), and it will benefit from a lower underlying price.

Pricing Forward Contracts

For further details, see Pricing Forward and Futures.

The value of underlying at today's prices (receiving delivery today) can be priced as

\[ S_0 = F e ^ { - rt }. \]

However, the counter-party risk would also need to be priced in, as these contracts are generally not liquid.