Futures contract

This is an introductory page in Options. If you are unfamiliar with any of the terms, you can refer to the Options Glossary.

A futures contract (future) is a standardized contract between two parties, to trade an asset at a specified price at a specified future date. The seller will deliver the underlying and the buyer will take delivery of the underlying and pay the agreed-upon price. The price that is agreed on is known as the future price or the delivery price and is determined when the contract is entered into. Since the price of the future is dependent on the price of the asset, this is a derivative instrument.

A futures contract is very similar to a forward contract. However, the futures market evolved to reduce the illiquidity and counter-party risk of the forward contract. A clearing house acts as the middleman, which performs the trade with both the buyer and seller. Clearinghouses overcome the potential credit risk by requiring the participants to put up an initial amount of cash, known as the initial margin. Futures positions are marked to market, and if there are insufficient funds, the exchange will require an additional maintenance margin, or is allowed to immediately liquidate the position.

True or False?

A futures contract has very low counter-party risk.

Features of a Future

Each contract is standardized. The following information has already been determined.

The underlying asset, including its quality:

The amount and quality of the underlying asset. For example, 1000 bushels of Grade 4 corn.The time of maturity \( T: \)

The date at which the underlying is to be delivered. This could be a specific date or a time range.The place of delivery for physical underlying:

The place(s) at which the underlying is to be delivered. This is often a centralized location that is close to the place of production or transport.

Some futures contract are cash settled, which means that the seller of the future transfers the associated payoff in cash. This avoids having to deal with delivery or transportation concerns.The initial margin and margin maintenance amount:

This is determined by the exchange. Typically, the initial margin is 2 to 10 percent of the full value of the futures contract. When the position moves against the trader leading to a drop below the maintenance amount, then the trader will receive a margin call to top up the margin account, or be forcibly liquidated out of his position.

This allows the exchange to limit the amount of counter-party risk involved.

Note that the price of the contract is not stated. Instead, it is determined by market forces.

A futures contract is similar to a forward contract in that they both agree to trade an underlying at a specified future date. However, future contracts

- are traded through an exchange,

- are standardized,

- require a margin, and

- have negligible counter-party risk.

You sell a May Gold Futures contract from a Lehman Brothers trader. What happens when Lehman collapses?

You sell a May Gold Futures contract from a Lehman Brothers trader. What happens when Lehman collapses?

Image credit: The logo is the trademark of Lehman Brothers.

Payoff Diagrams

The value of a futures position at maturity is the difference between the delivery price \( K \) and the underlying price \( S_T \) at the time of maturity:

- For a long position, the payoff is \( S_T - K \), and it will benefit from a higher underlying price.

- For a short position, the payoff is \( K - S_T \), and it will benefit from a lower underlying price.

Pricing Futures Contracts

For further details, see Pricing Forward and Futures.

The value of the physical delivery can be priced as

\[ F = S_0 e ^ { rt }. \]

How does the price of a future change as interest rate increases?

How does the price of a future change as interest rate increases?

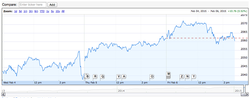

Image credit: Google Finance