Option value

This is an introductory page in Options. If you are unfamiliar with any of the terms, you can refer to the Options Glossary.

The option value is estimated through a predictive formula like Black Scholes or through a numerical method like Binomial Tree model. This price can often be interpreted as the expected value of the option on expiration, given the information in the market.

The value of an option can be divided into 2 parts:

- Intrinsic Value: The value of exercising an in the money option.

- Extrinsic (Time) Value The value of the price insurance obtained from the right to exercise (or not exercise) the option. This is always non-negative.

Contents

Intrinsic Value

For American options, the intrinsic value is easily calculated, as the expected profit from (smartly) exercising the option.

Let's say we have a call option. When the stock price \( S \) is greater than the strike price \( X \), then we can buy the stock at \(X\) through exercising the call and sell the stock at \(S\) in the market. This gives us an intrinsic value of \( S - X \). When the stock price \(S\) is lower then the strike price \(X\), then we would choose to not exercise the call option, hence it has an intrinsic value of 0. Thus,

\[ \text{Intrinsic value of Call} = \max( S - X , 0 ). \]

We can perform a similar analysis for the put option. When the stock price \(S \) is lower than the strike price \(X\), then exercising the put will allow us to buy the stock at \(S\) and sell the stock at \(X\) through exercising. This gives us an intrinsic value of \( X - S \). When the stock price \(S\) is higher than the strike price \(X\), then we would choose to not exercise the put option, hence it has an intrinsic value of 0. Thus,

\[ \text{Intrinsic value of Put} = \max( X-S , 0 ). \]

FB's current stock price is $75.89. A broker's market for the put option on the $80 strike expiring in 2 days is $3.75 bid at $4.00. Assuming no execution risk, what trade do you want to execute?

Assume that the risk-free interest rate is 0%, FB does not issue dividends, and that there are no transaction costs.

For European options, because they can only be exercised on expiry, the intrinsic value of the option is calculated on the future price, which would include any dividends that are to be paid out.

For example, if the stock is worth $30, we would typically expect the call option on the $25 strike to be worth at least $5, reflecting the intrinsic value. However, if the stock will be paying a dividend of $3 before expiry, then the future value of the stock is only \( $ 30 - $3 = $ 27 \) (and account for interest), and thus the option could be trading for less than $5.

As such, we have

\[ \text{Intrinsic value of Call} = \max( F - X , 0 ). \]

\[ \text{Intrinsic value of Put} = \max( X-F , 0 ). \]

The stock is trading at $20. The European call on the $10 strike expiring in 1 months is actively trading at $9. What trade do you want to execute?

Extrinsic Value

The time value of an option is the difference between the Option value and the Intrinsic Value.

\[ \text{Time value} = \text{ Option value } - \text{ Intrinsic value} \]

Note that this is always non-negative, as it reflects the right (but not obligation) to perform at trade at the strike price.

For European options with no possibility of early exercise, the time value of the put and call on the same strike and expiry are the same.

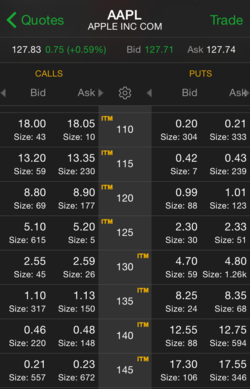

Sally expects that APPL stock will rise from its current price of $129.00 to $135.00 on March 20th. Assuming that her prediction comes true, which of the following option strategies would yield the most profit?

Sally expects that APPL stock will rise from its current price of $129.00 to $135.00 on March 20th. Assuming that her prediction comes true, which of the following option strategies would yield the most profit?

Note: No other corresponding trades are done. In particular, she does not hedge her delta exposure.

Ignore interest rate and transaction costs.

There are no dividends.

The image doesn't show the price of options when AAPL is at $129.00.

Image credit: Thinkorswim

For American options, the time value of the put and the call could be slightly different, to reflect the early exercise premium. For example, a deep-in-the-money call that will be early exercised may be trading at intrinsic value (and thus has no time value), while the put could be trading way above $0. Having said that, for options that are close to at-the-money or are expiring soon, the calls and puts will have the same time value.